Optimizing Financial Operations: The Role of Accounts Receivable and Payable Services

Managing financial operations efficiently can make or break a company’s success in today’s competitive business landscape. Accounts receivable and payable services are pivotal in ensuring smooth cash flow and financial stability.

Understanding Accounts Receivable and Payable Services

Accounts receivable (AR) and accounts payable (AP) are crucial components of financial management. AR involves managing the money owed to a company by its customers, while AP focuses on the company’s debts and payments to suppliers and vendors.

Key Components and Processes

Managing AR involves invoicing, tracking payments, and following up on overdue accounts. AP management includes invoice processing, payment scheduling, and maintaining accurate financial records.

Importance

Accounts receivable represent the outstanding payments due to a company for goods or services provided. Efficient AR management ensures timely collection, directly impacting cash flow and liquidity.

On the other hand, accounts payable are the company’s short-term debts to suppliers for goods or services purchased on credit. Proper AP management is essential for maintaining positive vendor relationships and optimizing payment schedules.

Benefits of Outsourcing Accounts Receivable and Payable

Outsourcing AR and AP services offers numerous advantages for businesses:

Improved Cash Flow Management

By outsourcing AR, businesses can accelerate cash inflows, reduce payment cycles, and minimize bad debt risks. AP outsourcing streamlines payment processes, avoids late fees, and optimizes cash outflows.

Enhanced Accuracy and Compliance

Professional AR/AP service providers ensure accuracy in financial transactions, reducing errors and improving compliance with financial regulations and tax laws.

Choosing the Right Accounts Receivable and Payable Service Provider

When selecting an AR/AP service provider, consider:

Factors to Consider

- Experience and reputation in the industry

- Range of services offered (invoicing, collections, vendor management)

- Technology and security measures

- Cost-effectiveness and scalability of services

Why Square One Teleglobal Stands Out

At Square One Teleglobal, we deliver tailored AR and AP solutions that align with your business needs. With a focus on efficiency, accuracy, and client satisfaction, we ensure seamless financial operations.

Industry-specific Applications of Accounts Receivable and Payable Services

Accounts receivable and payable services are vital across various industries:

Retail

In retail, managing AR efficiently ensures steady cash flow amid fluctuating consumer spending patterns. AP services help maintain strong supplier relationships and optimize inventory management.

Healthcare

For healthcare providers, timely AR management is critical for handling insurance claims and patient billing. AP services streamline payments to suppliers and support cost-effective healthcare delivery.

Technology

In the tech industry, AR/AP services facilitate efficient billing for software licenses and subscriptions. AP management helps tech companies manage vendor relationships and control procurement costs.

Security Guard Services

We can handle calls for security companies, ensuring all incidents are reported and managed promptly.

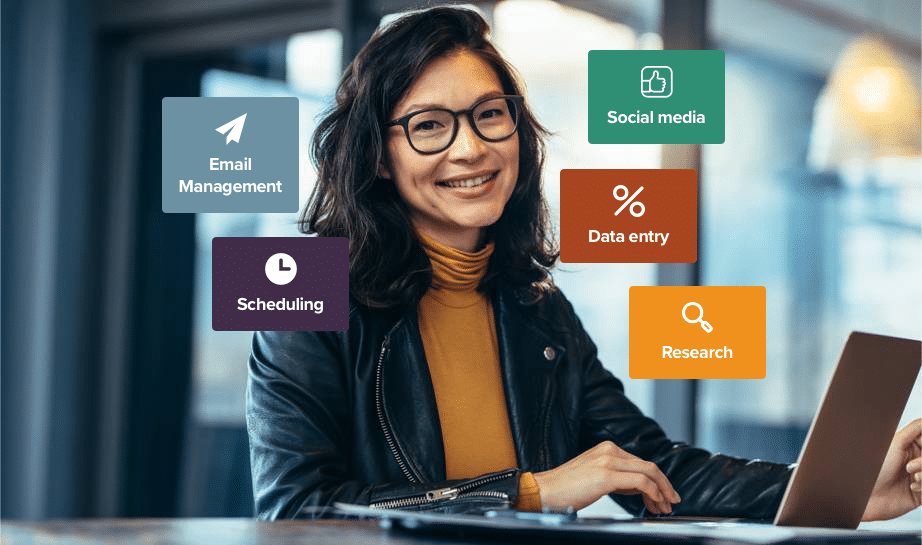

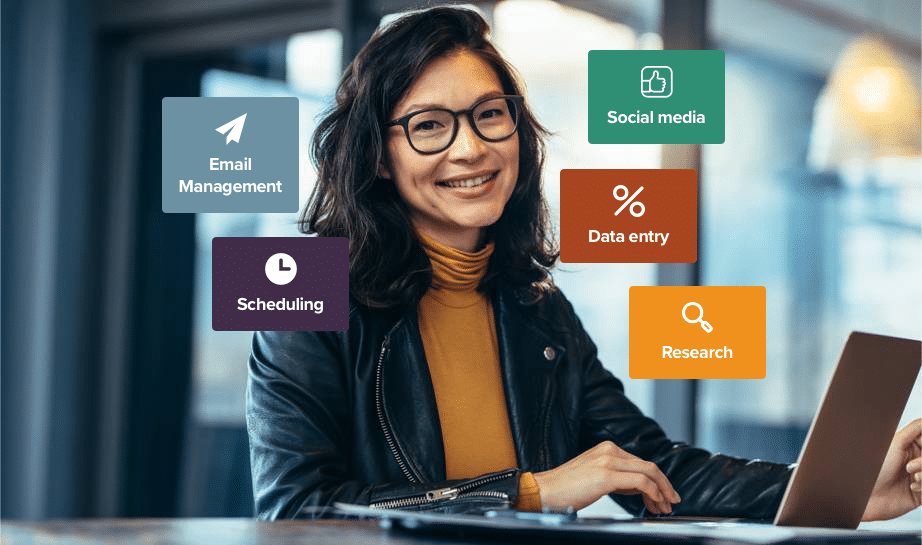

What Square One Teleglobal Can Offer You

High Quality, Low Cost

We provide top-notch services at affordable prices.

Customized to Your Business

Our services are tailored to meet the unique needs of your business.

Years of Experience

With years of experience, we know how to handle your calls professionally.

24/7 Advanced Customer Support

We are available around the clock to support your business.

Excellent English

Our agents are fluent in English, ensuring clear communication with your customers.

Well Trained & Educated Associates

Our team is well-trained and knowledgeable, ready to assist your customers effectively.

Streamlining Your Financial Strategy

Implementing efficient AR and AP practices is essential for optimizing your financial strategy:

Steps to Implement Efficient Accounts Receivable and Payable Practices

Adopt automated invoicing and payment systems.

Regularly monitor aging accounts and payment schedules.

Leverage analytics to forecast cash flow and optimize working capital.

Square One Teleglobal Our Main Markets

Contact Us for Tailored Solutions

At Square One Teleglobal, we empower businesses to achieve financial excellence through our comprehensive AR and AP services. Contact us today to discover how we can streamline your financial operations and drive business growth.

FAQs

Accounts receivable involves managing customer payments owed to a company, while accounts payable handles the company's debts to suppliers.

Outsourcing improves cash flow management, enhances accuracy, and allows businesses to focus on core activities.

Square One Teleglobal offers customized solutions tailored to your business needs, ensuring efficient financial operations.